In today’s financial sector, it has become important for every individual and every entity to have all the legal and required documents to carry out any kind of financial activity. In India, individuals and enterprises are required to have a Permanent Account Number (PAN card)for financial identity and to carry out financial transactions. So that by the end of a particular financial year, these individuals and the enterprises can file for Income Tax returns.

However, if you are a newbie and do not know much about the PAN Card, Income tax returns and what financial identity means, then this blog is a perfect article which will talk about what a PAN card is and how it is used by people and businesses for their financial identity and income tax returns.

What is a PAN Card?

A PAN is the short form of Permanent Account Number. It is used by the government of India and is a 10-character alphanumeric identifier which is issued to the Indian taxpayers. With the help of this 10-digit alphanumeric identifier, the government can keep track of all the financial records carried out by individuals; it also helps them keep a tab on the income tax filed by the people of India. The PAN card remains the same throughout the lifetime of the individual. Whether it is regarding the name, address, or phone number.

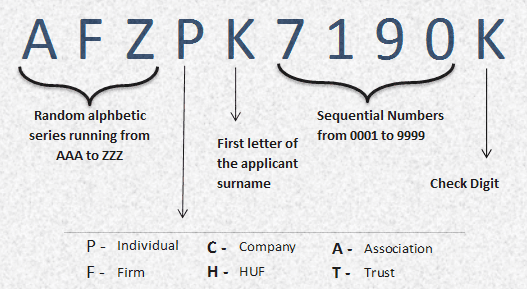

Decoding the Structure of PAN

When you apply for a PAN Card and receive your PAN Card, you will see the following details mentioned on your PAN Card.

The First Five Characters, which are alphabet:

- The first three characters on the PAN Card are a random sequence of letters starting from “A to Z”.

- The fourth letter or character indicates the type of PAN holder:

- A is for AOP- Association of Persons.

- B is for BOI- Body of Individuals

- C stands for Company.

- F is for Firms.

- G stands for Government

- H is for HUF- Hindu Undivided Family

- L is for Local Authority

- J is for Artificial Juridical Person

- P is for Person- Individual

- T is for Trust- AOP

3. The fifth character is the first character of the PAN holder’s last name or surname.

4. The following four characters, which are numeric, are a sequential set of numbers from 0001 to 9999.

5. The Last Character is an alphabet again, which is used as an alphabetical check digit for verification.

Why is a PAN Card Important?

A PAN card is important for various financial identification, financial and non-financial transactions. Its importance can be highlighted in the following areas:

- Income Tax Returns: A PAN is compulsory for the filing of the income tax returns in India. It helps the Income Tax Department track all the taxable financial transactions.

- Bank Accounts: The PAN card is also required to open a new bank account, which includes savings, current and fixed deposit accounts.

- High-Value Transactions: The transactions which will be done in case of buying or selling property, vehicles or investments areexceedg a specified limit require PAN.

- Credit and Loans: The PAN card is necessary to apply for loans or credit cards.

- Investments: The PAN card is required to invest in mutual funds, stocks and other financial instruments. Hence proving that it is important for financial identification.

- Foreign Travel: A PAN card is very much needed for transactions that are related to foreign travel, such as buying foreign currency.

- Telephone Connections: Apart from financial identity, A PAN Card is also used for obtaining a new telephone number or a mobile phone connection.

- Demat Accounts: A PAN is necessary for opening a demat account for the transactions of shares and other commodities.

- Fixed Deposits: A PAN card is required to open a fixed deposit with banks when exceeding a specified limit.

How to apply for a PAN Card online?

The application process for a PAN card online is very straightforward and can be completed both online and offline. Here is a step-by-step guide on how to do so:

If you are an individual who is an adult, meaning you are of the age of 18 or 18 +, then you can easily fill the form online and attach your Aadhar card details for verification and linking the Aadhar card with the PAN card. However, if you are below 18, then you can fill in the form online, but you have to physically submit your documents.

- Visit the official Website: First visit and navigate the official website of NSDL, which is National Securities Depository Limited, or UTIITS, L, which is UTI Infrastructure Technology and Services Limited.

- Fill out the form: Then select the appropriate form, like Form 49A for Indian citizens and Form 49AA for foreign citizens, and also fill in the required details.

- Upload all the relevant documents: Upload proof of identification, proof of address and proof of date of birth, like a birth certificate.

- Payment: After filling in all the details and attaching all the soft copies of the documents needed, you have to move forward with the payment to process the application.

- Acknowledgement: An acknowledgement number will be provided upon successful submission, which can be used to track the application status.

Within a few days, you will receive your PAN Card at the mentioned address in the form.

Conclusion

For Indian citizens or the international foreign nationals who are residing in India, it is important for them to be a PAN Card holder. A PAN Card is a very important document and financial identity when it comes to carrying out financial or non-financial transactions. The government of India also makes sure that every individual, whether living or non-living, like an individual or a business with multi-chains or a single entity, has a PAN card for tracking and keeping records of Income Tax returns.

Therefore, if you do not have a PAN Card, then it is advisable to apply for a PAN Card and link it with your Aadhar card too, as per the new guidelines of the Indian government.