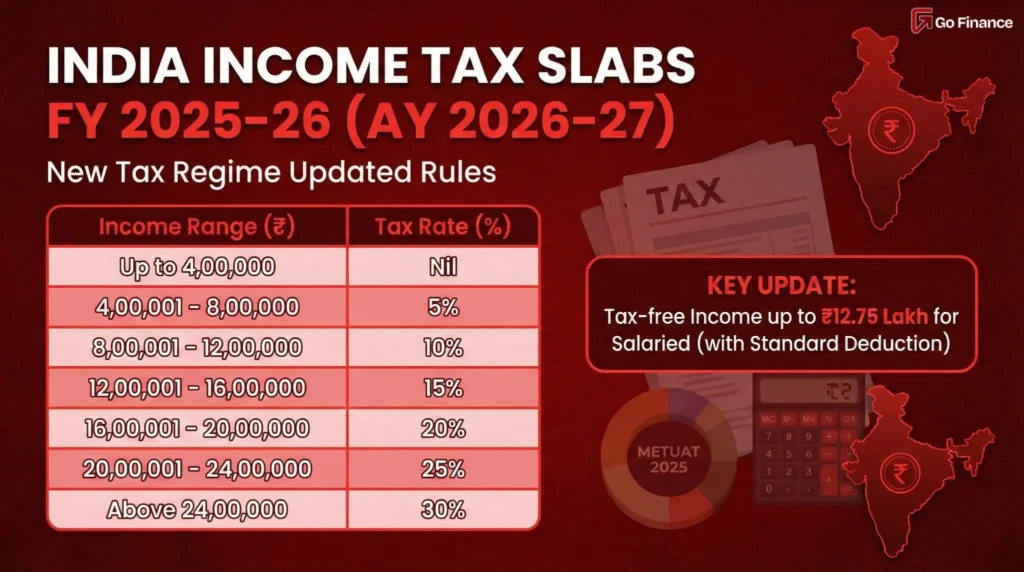

2026 Income-Tax Law in India: What the Income-tax Act, 2025 Means for Salaried and Self-Employed.

India’s tax landscape is set for a major shift with the upcoming Income-tax Act, 2025, which will shape how both salaried individuals and self-employed professionals manage their finances in the year ahead. As discussions intensify around the Income Tax 2026 India framework, taxpayers are eager to understand what might change, especially when it comes to […]

What is Form 16? A Complete Guide to Components, Eligibility & Benefits

Ever looked at your salary slip and given a thought about where your taxed money actually goes, and why every time in June, your HR becomes the most important person in your life? Here is where Form 16 comes in, the ultimate document that decides whether your ITR filing feels like a smooth ride or […]

Permanent Account Number (PAN): What It Is and Why It’s Important

In today’s financial sector, it has become important for every individual and every entity to have all the legal and required documents to carry out any kind of financial activity. In India, individuals and enterprises are required to have a Permanent Account Number (PAN card)for financial identity and to carry out financial transactions. So that […]