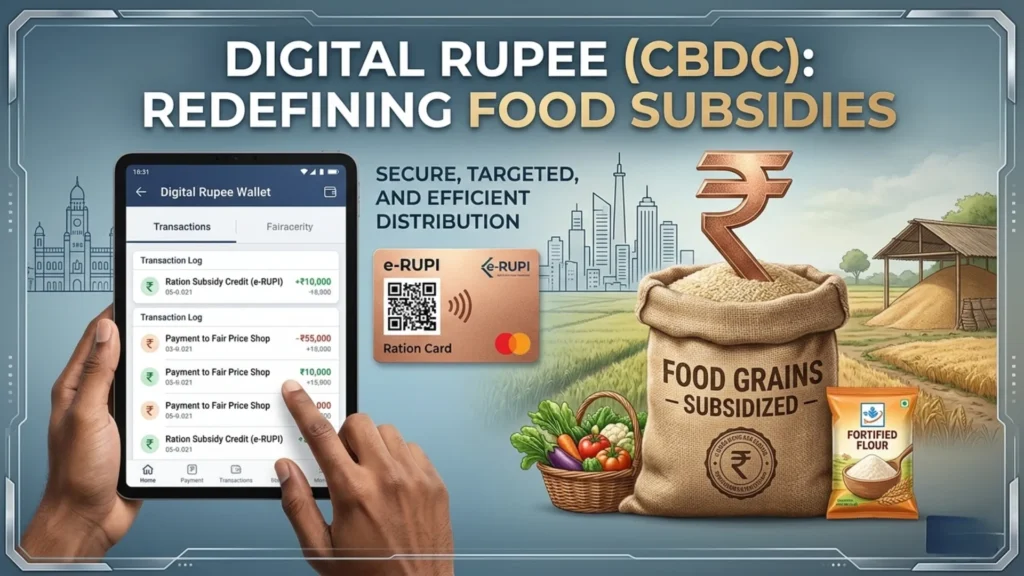

Digital Rupee for Food Subsidies: A New Era in India’s Digital Payments and Welfare System

India has made a significant step in the way of implementing the digital currency of central banks into the sphere of real welfare. In a report by CNBC-TV18, the government has introduced a pilot on the digital rupee which was used to deliver food subsidies on the Pradhan Mantri Garib Kalyan Anna Yojana. This evolution […]